After a couple weak monthly reports, U.S. employment roared back in October. The U.S. created 531,000 new jobs, beating expectations for 412,500. August and September were both revised higher by more than 100,000 jobs. Private payroll increased 604,000 while government payrolls shrank 73,000. Unemployment dipped from 4.8% to 4.6%.

Key Points for the Week

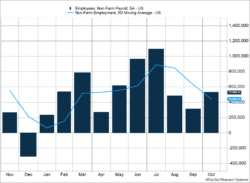

- The U.S. employment report was full of good news. Nonfarm payrolls increased 531,000 in October and previous months were revised higher.

- The Federal Reserve announced the tapering of bond buying with purchases ending by July 2022.

- Strong earnings, strengthening employment, and a supportive central bank propelled the S&P 500 to a record high.

The strong jobs report supports the Fed’s decision earlier in the week to begin tapering its bond purchases. The current $120 billion will be reduced by $15 billion each month, beginning in November and ending in July of next year.

The S&P 500 added on 2.0% and surged to a new record high. The MSCI ACWI jumped 1.6% as international stocks joined the U.S. rally. The Bloomberg U.S. Aggregate Bond Index increased 0.6%. Rates fell in response to the Fed’s comments suggesting it doesn’t expect to raise rates until late 2022 or early 2023.

Figure 1

Big Week

Last week was a big week. Employment, the Fed, political trends, and COVID-19 all generated significant news that suggests the recovery from the pandemic is moving into a new phase that is less reliant on the Federal Reserve and more reliant on underlying growth trends.

The strong employment data and upward revisions in previous months showed the decline in COVID cases and the end of extra unemployment benefits are starting to spur people to return to work and fill many open positions. As Figure 1 shows, 531,000 new jobs aren’t the highest this year, but they are much improved from the original August and September reports. Figure 1 reflects revisions that added 117,00 jobs in August and 118,000 jobs in September.

Job gains in restaurants and related industries accounted for 27% of the increase in private sector jobs. Capitalism is causing many companies to work hard to solve the goods shortages and transportation issues plaguing some parts of the economy. Manufacturing jobs jumped 60,000, and transportation and warehousing added 54,000 new positions. The unemployment rate continued to grind steadily lower and reached 4.6%. The percentage of people out of work for more than 52 weeks dropped from 30% in May to 24.2% last month.

The Federal Reserve announced it would gradually taper or reduce its bond-buying program. The Fed has been purchasing $120 billion worth of bonds since March 2020. The program is designed to push long-term rates lower by buying up long-term government debt. Lower rates for government debt increase demand for corporate bonds or other areas of the market, providing liquidity for those needing to roll over debt. It also helps keep mortgage rates low, encouraging home building and allowing some borrowers to reduce interest payments. Given the strength in the employment data and other areas, the economy no longer needs bond buying to support growth.

Support from the fiscal side appears likely to provide its own boost as the bond buying goes away. The House of Representatives reprioritized the infrastructure bill in response to results from governors’ races in Virginia and New Jersey. The bill contains money for a wide range of projects and transportation infrastructure improvements. The bill includes money to expand charging stations that may help electronic vehicles become a better option for many drivers. Global leaders met in Scotland last week to discuss how to battle climate change.

Two new COVID breakthroughs will likely allow more reopening to occur. Children ages 5-11 are now receiving COVID shots, which will lead more families to reengage in a broader set of economic activity. Results from a therapeutic trial indicated an additional treatment may be approved that reduces hospitalization and serious illness for those who get COVID.

The key risk areas that have held the economy back look better than a week ago. Employment resumed its recovery, and the Fed removed some of its extraordinary measures. The president looks likely to sign a key infrastructure bill, and the effects of COVID are likely to continue to wane. Overall, this week was full of generally good news.

–

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.bls.gov/news.release/empsit.nr0.htm

https://insight.factset.com/sp-500-earnings-season-update-november-5-2021

https://www.yahoo.com/now/democratic-lawmakers-blame-infrastructure-bill-181100214.html

https://www.cnn.com/2021/07/28/politics/infrastructure-bill-explained/index.html

https://www.federalreserve.gov/newsevents/pressreleases/monetary20211103a.htm

https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20211103.pdf

Compliance Case # 01179668